Local and federal taxes are a standard element in any invoice.

A sales tax exemption certificates enables your customers to make tax-free purchases for products that are otherwise subject to a sales tax. Different products and services require different tax-exempt certificates.

For example, you are an executive in the billing department of a company that manufactures and sells solar panels. Solar panels are exempt from sales tax in several states and countries. Before you generate an invoice for customers who have made a purchase, you must associate a tax exemption certificate to the customer’s Account or Account location to make the purchase tax free.

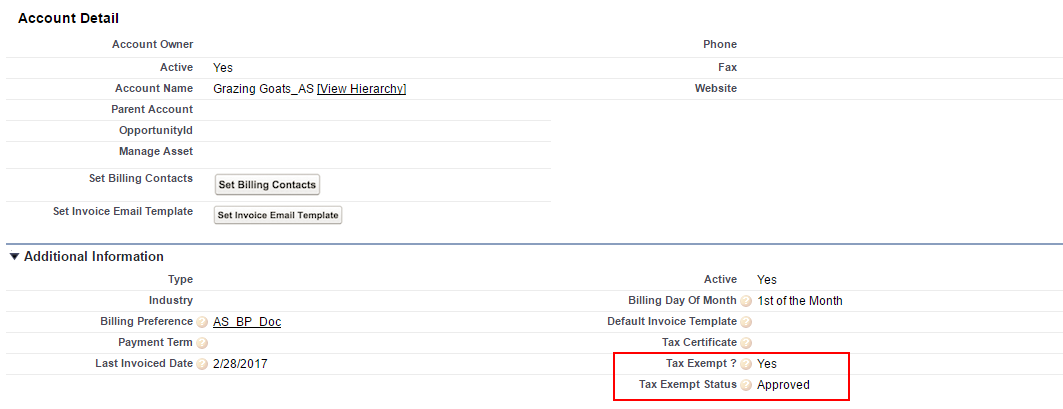

You must first make sure the Tax Exempt Status of the customer’s account is Approved.

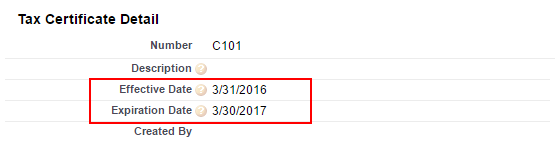

To make your customer’s purchase tax free, you must generate the invoice on a date including or between the Effective and Expiration dates of the Tax Certificate.

Your customers are required to pay taxes for most products or services they purchase from you. You can define if a tax is applicable to a certain price list item, define the tax amount, a tax code, if the price includes tax, or if the item is exempt from taxes.

However, before you begin to define applicable taxes, you must edit the Accounts page layout to include the fields described in the following table:

| Field | Description |

|---|

| Payment Terms | Select a predefined Payment terms |

| Tax Exemption | Select the check box if the account and account location can have Tax exemption. |

| Additional Invoice delivery Address | A semi-colon separated list of email addresses where your customers want the invoice delivered. |

| Last Invoice Through Date | The last time invoice run selected the account and the Invoice through date, assuming the account was selected |

You can now integrate the Conga Billing application with the a thrid-party Tax engine to:

- Automate tax calculation

- Map tax codes with each bundle or standalone product

- Calculate the tax for the amount of every Invoice Line Item and attach the corresponding list of tax breakups to each Invoice Line Item

- Use the Account Location address if the corresponding Asset Line item has an account location defined

- Use the Bill-to Account address if the corresponding Asset Line Item does NOT have an account location

- Aggregate the tax of all non-informational Invoice Line Items and store that amount in the Total Tax Amount field of the Invoice

- Aggregate the tax breakups of all non-informational Invoice Line Items and attach the aggregate tax breakups to the Invoice

- Define tax exempt status and certificate for reference

- Reference tax related information on the third-party web service for tax

Each Invoice Line Item has a list of Tax Breakups. A Tax Break is a list of 1 or more objects that describe how the tax amount is to be sub-divided (or broken up) by other parties (state, county, district, city) that are entitled to a portion of the tax amount.