Download PDF

Download page Credit and Rebill.

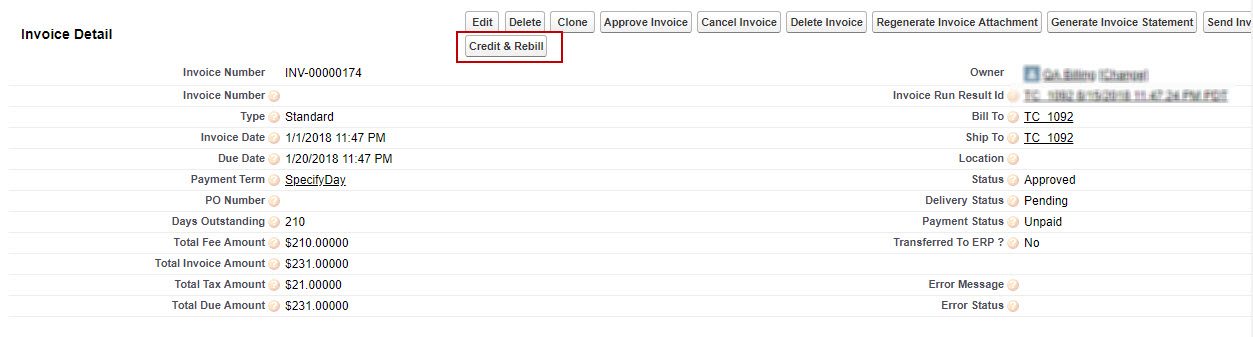

Credit and Rebill

The Credit & Rebill feature allows you to credit the entire invoice and rebill it. This is helpful when you want to make any changes to the invoice without any pricing change or any impact on the billing schedules.

Credit & Rebill creates credit memo line items for each invoice line item. The credit amount is equal to the invoice amount. When you approve the credit memo, a Related A/R transaction record is created with the "Credit & Rebill" reason code. The status of all the billing schedules changes to Pending Billing.

Credit & Rebill functionality is only applicable for:

- Approved invoices

- Approved invoice that is not yet paid or partially paid

- Invoices with no associated credit memos

To apply credit and rebill

- Navigate to the invoice on which you want to apply Credit & Rebill.

- Click Credit & Rebill.

Billing displays the summary of the credit memo line items that are created and the impact on the existing billing schedules. - Select the credit memo processing options:

- Auto Approve credit memo: When enabled, after you click Submit, Billing approves the credit memo automatically.

- Unrate the usage inputs: When enabled, after you click Submit, Billing reverses the usage inputs with Credit & Rebill. Billing displays this checkbox only if the invoice has at least one invoice line item that has a usage schedule. Billing enables this checkbox only after you select the Auto Approve credit memo checkbox.

Click Submit. Billing creates a credit memo, changes the Status of the invoice to Credited, and changes the Payment Status to Paid. You will see the following results based on the Auto Approve credit memo and Unrate the usage inputs options.

Option Selected Result Auto Approve credit memo Yes Credit memo line items are created in the Approved status. A Related A/R Transaction record is created and the status of all the billing schedules changes to Pending Billing. No Credit memo line items are created in the Draft Status. After you manually approve the credit memo, the Related A/R Transaction record and the status of all the billing schedules change to Pending Billing. For more information, see Managing Credit Memos vFebruary-23. Unrate the usage inputs Yes Billing unrates the usage inputs for the billing schedules while auto-approving the credit memo. Billing changes the status of billing schedules and the corresponding usage schedules to

Pending Billing. Billing unrates all associated usage inputs for the usage schedules, changes the Fee Amount on the billing schedule and usage schedule to 0.00, and resets the quantity on the usage schedule. If there are more than 1000 usage inputs, Billing unrates usage inputs in an asynchronous batch mode.No Billing does not unrate the usage inputs for the billing schedules while auto-approving the credit memo. However, you can unrate the usage inputs while approving the credit memo manually. For more information, see Managing Credit Memos vFebruary-23.

Invoice the billing schedules to rebill them.

Credit and Rebill from Wallet Asset Line Item (WALI)

You can initiate Credit & Rebill operation from an invoice associated with a WALI.

When the custom setting Wallet’s Balance Based on its Invoicing is set to True and you attempt a Credit & Rebill operation from an invoice linked to a WALI, the system validates if there’s enough available balance in the wallet. If the sum of fee amounts of all the invoice line items referencing an individual WALI is less than or equal to the WALI available balance, the Credit & Rebill operation is allowed, else it is rejected and the UI displays an error message.

For example, assume you have created a wallet with the following details:

Asset Name | Start Date | End Date | Selling/Billing Frequency | Quantity | Charge Type | Price Type | TCV | Net Unit Price |

|---|---|---|---|---|---|---|---|---|

| Wallet |

|

| Monthly | 1.00 | Standard Price | Recurring | USD 1,200.00 | USD 1,200.00 |

When billing is initiated, 12 billing schedules are created in a Pending Billing status.

You have invoiced the first two billing schedules:

Billing Schedule ID | Period Start Date | Period End Date | Fee Amount | Type | Status | Invoice Line Item ID | Invoice ID |

|---|---|---|---|---|---|---|---|

BS-001 |

|

| USD 100.00 | Contracted | Invoiced | ILI-001 | INV-001 |

BS-002 |

|

| USD 100.00 | Contracted | Invoiced | ILI-002 | INV-001 |

BS-003 to BS-011 | .... | .... | .... | ... | .... | ... | .... |

BS-012 |

|

| USD 100.00 | Contracted | Pending Billing | NA | NA |

The WALI page displays the balance as:

- Total Balance (Wallet) = USD 200.00 and

- Available Balance (Wallet) = USD 200.00

You consumed the wallet balance against a related asset line item (RALI) for USD 150.00. After this transaction, the wallet's available balance is USD 50.00. Now if you initiate the Credit & Rebill operation for the invoice INV-001, Billing won't allow you to do so because the WALI is already consumed and if credit is given it leads to a revenue leakage. Billing validates the sum of fee amounts of the invoice lines against the wallet's available balance. Here the sum of fee amounts of ILI1+ILI2 (USD 100.00 + USD 100.00) is greater than the available balance of USD 50.00 of the wallet, so the Credit & Rebill operation for the invoice INV-001 is not allowed.

In other words, if the available balance of the wallet is greater than or equal to the combined balance of the invoice line items then Credit & Rebill operation is allowed. After the operation is completed, the status of the billing schedules is updated to Pending Billing. For more information on how to carry out Credit & Rebill, see To apply credit and rebill.