Download PDF

Download page Account Settings.

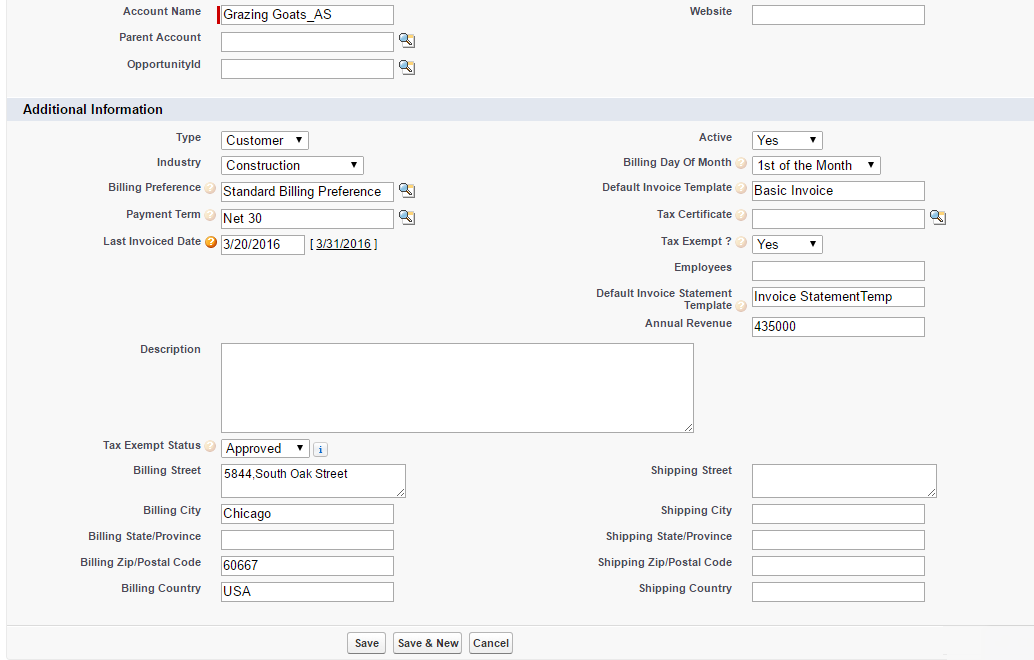

Account Settings

You will always generate an invoice for your customers' account.

Account is a standard Salesforce object from which all Conga applications inherit values that you define. Conga Billing uses values from the fields that you define in the Account object.

The information specific to billing and invoicing that you must define in the Additional Information section of the Accounts page are described in the following table.

| Field | Description |

|---|---|

| Billing Preference | Select a predefined billing preference. For details, see Billing Preference. |

| Billing Day of the Month | The day you want to generate a bill for the account. To apply this configuration, please set Billing Cycle Start to Account Billing Day of Month on Billing Preference associated with this account. |

| Calendar Cycle Start | Select a month to align the account's billing to a specific calendar year. To apply this configuration, please set Calendar Cycle Start to Account Calendar Cycle Start on Billing Preference associated with this account. |

| Payment Term | Select a predefined payment term. For details, see Payment Terms. |

| Default Invoice Template | Select a template on which all invoices you generate for this account will be based. This will be an attachment to the invoice email. |

| Set Invoice Email Template | Set an invoice template that will be applied to the email body for sending invoice emails. Click Set Invoice Email Template and select a template. For information on creating an email template, refer Templates. |

| Default Invoice Statement Template | Select an invoice statement template on which all invoice statements you generate for this account will be based. For information on invoice statement templates, refer Generating an Invoice Statement. |

| Set Billing Contacts | Set filter criteria to pick a Billing Contact where you want to email the automatically generated invoices or credit memos. Refer Billing Contacts for details. For more information on Sending Email Invoices, please refer Processing Options, under Invoice Runs. |

| Set Credit Memo Email Template | Choose an email template that will be applied to the email body for sending Credit Memo emails from an Account. Click Set Credit Memo Email Template, select an email template from the picklist and Save. For information on creating a custom email template for Credit Memos, please refer Credit Memo Template. |

| Credit Memo Email Template | Value fetched from Set Credit Memo Email Template. The selected email template for Credit Memo will be visible here. You can also type in the email template name. |

| Set Default Credit Memo Template | Choose a template on which all Credit Memos you generate for this Account will be based. This will be an attachment to the emails sent for all Credit Memos from the account. |

| Default Credit Memo Template | Value fetched from Default Credit Memo Template. The selected template for Credit Memo attachment will be visible here. You can also type in the template name. For information on how to add a Credit Memo template, refer Credit Memo Template. |

| Tax Certificate | Select the certificate you want to apply to this account. For details, see Associating a Tax Exemption Certificate. |

| Tax Exempt? | Select from one of the following options.

|

| Tax Exempt Status | Select from one of the following options.

|

| Billing Address | Enter the address where your customer wants to receive the invoice. |

| Shipping Address | Enter the address where your customer wants to receive the products. |

| Dunning Policy | Select a Dunning Policy to override the default dunning policy with an account specific dunning policy. For details, see Dunning Policy. |

| Exclude from Dunning | Select this field to disable dunning for this account. |

| Late Fee | Select the late fee to apply penalty charges. |

For different Account Locations, you can add a different Invoice Template and Billing Contact.

For example, you are an executive in the billing department of a software company. One of your customers is an online university called DigiReads. DigiReads offers several online training programs and skill enhancement initiatives for soldiers on active duty and veterans. This institute is exempt from both, state and federal taxes. You must use the fields described in the table above to define all information required to generate an invoice for this customer.

After you save information on the Accounts page, you must define the Account Locations.